Korea’s finance industry is in crisis. Last July, the delinquency rate of the Korean Federation of Community Credit Cooperatives (KFCC) soared to a record-high level — sparking public fears of a bank run. However, this was only the start of the crisis, as concerns regarding financial institutions’ real estate investments have continuously arisen. Thus, the Sungkyun Times (SKT) now looks into the factors that triggered the recent issues and determines the future direction the industry should take.

Current Status of Korea's Financial Industry

Since the second half of 2023, the Korean economy has suffered a recession. According to major investment banks (IB), Korea’s economic growth rate is expected to record only about 1% in both 2023 and 2024. The finance sector has pointed out the following two factors of the economic downturn: an increase in default rates on real estate project financing (PF) loans and excessive investment in global alternative assets. The PF refers to the funding that is executed based on the profitability of a project. Unlike general funding, which is based on the borrower’s current repayability, the PF relies on future cash flow. Therefore, it is used in long-term, large-scale projects such as real estate investment. Recently, aggressive PF lending by domestic institutions has raised the danger of insolvency, represented as concerns over the KFCC’s bank run. Second, alternative investments refer to a strategy of investing in non-traditional assets such as digital currency and real estate. Since 2017, financial institutions have shown interest in foreign real estate, when the low interest rate trend continued in Korea for a long period. According to a September announcement by the Bank of Korea, the scale of global alternative investment has surpassed ₩155 trillion in 2023.

The Real Crisis Has Come

-A Broken Bridge

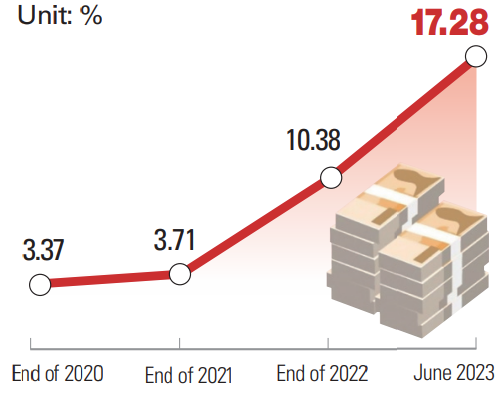

The biggest issue in Korea’s real estate PF is that it lost its initial purpose of serving funds for construction. In general real estate development projects, the developer has to acquire land before construction. When purchasing land, most domestic developers who lack enough equity utilize a high interest loan called a bridge loan. In fact, the Korea Institute of Finance reported in June that the developers of apartment development projects receive 70-90% of the funds required for land purchase by using bridge loans. The main problem is that the developers redeem the bridge loan with the PF loan offered during the construction process. Moreover, the gap in the PF loan caused by the bridge loan repayment is mended through the deposit of building buyers. Lee Bo-mi, a researcher at the Korea Institute of Finance, stated, “The vicious circle where one loan is used to pay off another burdens every institution participating in the investment.” In addition to the unstable investment structure, the recent real estate market decline has triggered economic s t a g n a t i o n . F o r instance, domestic stock firm’s PF loan default rate surged to 17.28% in June, in contrast to 3.37% at the end of 2020.

-House of Cards

Concerns about global alternative investment insolvency have also been expressed. In September, the NICE Investors Service announced that more than half of ₩6 trillion, the exposure amount of real estate finance, is concentrated in foreign regions. The main factor of the crisis is the rapid change in the investment environment due to the pandemic and the Russo-Ukrainian War. As the leading countries raised their interest rates, most of the foreign real estate suffered unprecedented depreciation; consequently, the Korean investors experienced significant losses. For instance, Mirae Asset Securities (MAS), which invested ₩280 billion in Hong Kong’s Goldin Financial Global Centre in 2019, decided to write off 90% of the investments in July as the building’s value plunged after the pandemic. MAS had to suffer a loss since only senior lenders such as Deutsche Bank got their principal sum back by selling the building. As most domestic institutions invested in overseas property through mezzanine loans, fears of insolvency arose. Furthermore, the financial risks of corporations could be spread to investors through a foreign real estate products’ sell-down. In fact, the Maeil Business Newspaper revealed that some of the malignant unsold global real estate is promoted in Gangnam District’s private banking branches, deceived as a “product that creates fixed revenue.”

Fixing the Fundamental Flaws

Recently, the financial authorities announced that problems regarding real estate are adjustable. However, enhancing the current investment structure is essential to prevent further risks. First, the developer must be able to obtain sufficient equity in the real estate business. The United States (U.S.) could be a great model for the PF; the developer and investors of the U.S. form a limited liability company to raise 20-30% amount of the total cost for the project. This sets the loan for purchasing lands to be 40-50%, a stable amount to serve the project. Although the market in Korea differs from the U.S., researcher Lee stated, “The PF structure in the U.S. could be applied in the commercial real estate business in Korea, where the scale of the project is relatively small.” Additionally, methods that protect mezzanine lenders from potential loss must be established. In response to the situation, the Financial Supervisory Service (FSS) stated, “Remedies that can enhance the probability of investment retrievements should be modified.” Furthermore, there should be restrictions that prohibit corporation investors from shifting their financial risks to individuals. Although the FSS stated to reinforce the inspection process in selling financial products, further methods to regulate institutions should be implemented.

The real estate development project is an attractive option for many investors. However, the finance industry has faced great danger due to recent fluctuations in various macroeconomic indicators. Through this crisis, the SKT hopes the Korean financial industry will shift toward a more sustainable future investment direction.