Lithium, also known as “white gold,” has been thrown into the limelight during the last few years as the key component of batteries. However, despite the prolonged high demand, lithium recently saw an unexpected price drop that reached a low of ¥162.50 last October, due to global recession and sluggish demand for electric vehicles (EV). Accordingly, the Sungkyun Times (SKT) aims to follow lithium batteries and their social impact.

Lithium, The White Gold

- What Are Lithium-Ion Batteries?

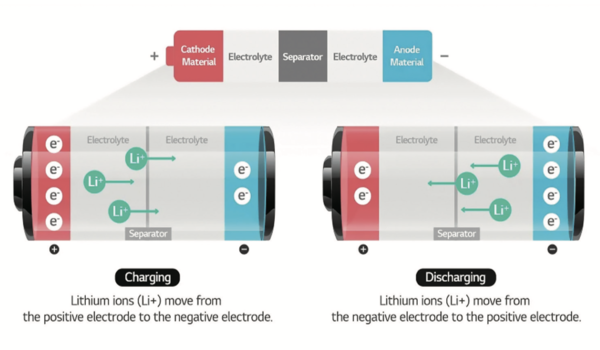

Lithium is a lightweight alkaline metal that has high electrical conductivity, which functions as the key material for rechargeable batteries. The four components of a battery are the cathode, anode, electrolyte, and separator; out of these four elements, lithium is the main material of the cathode and anode, which determines the capacity and voltage of the battery. An electrolyte is a medium that helps the movement of ions, and the separator works as a barrier that prevents contact between the cathode and anode. The mechanism of lithium-ion batteries involves the ions moving between the cathode and anode materials through the electrolyte, generating an electrical current. The lithium-ion moving from the cathode to the anode charges the battery, while the ion returning from the anode to the cathode releases energy and discharges the battery. Such batteries can store energy at a high density, and the reactive properties and charging convenience of lithium-ions improve battery performance. This material is used in various electronic products such as EVs, smartphones, and laptops. As one of the essential elements of modern technology, the use of lithium-ion batteries is expected to expand to devices running with rechargeable batteries, such as drones, robots, and electric planes, in the upcoming mobility era.

- Struggles for Lithium Acquisition

As the EV market has grown over the past decade, many efforts have been made globally to obtain lithium. According to the 2022 data by SNE Research, a rechargeable battery industry research institute, the global EV market has grown to 13.21 million units, approximately 10 times higher than a decade ago. In response, China invested $10 billion last April to gain lithium, cooperating with Afghanistan to access its mineral deposits. However, some countries are nationalizing their reserves for strategic reasons. For instance, the Mexican government canceled lithium mining concessions held by a Chinese company last September for failing to meet the minimum investment requirements. Under these circumstances, Korea has also entered the competition due to the growth of the lithium-ion battery industry, which now plays a crucial role in Korea’s economy. Last year, according to the 2022 statistics by the Korea Customs Service, Korea’s exports of lithium batteries for EVs reached $2.6 billion, the highest figure so far. In fact, Pohang Iron and Steel Company (POSCO) acquired Argentine salt lakes in 2018, allowing the production of around 100,000 tons of lithium that can be sold exclusively by Korean companies when the official plant is completed in 2024.

Batteries Backfiring

- Technical Obstacles

Despite their high energy density, the EVs show lower capability compared to other cars in actual practice. According to the 2021 data from the International Energy Agency, EVs with lithium batteries had an average mileage of 349km on a single charge, significantly lower than gasoline-powered vehicles with an average of 664km. Besides this, unlike gasoline cars that take less than five minutes to fully refuel, EVs take more than four hours with slow charging and a minimum of 30 minutes with rapid charging. Kim Soo-hee, a user of an EV, spoke to the SKT, “I find it uncomfortable that when driving on the highway, I have to stop every two hours for several tens of minutes to recharge.” Furthermore, the electrolytes used in lithium batteries are dense, flammable organic materials that increase the risk of fire or explosion. According to the 2019 report by Verband der Sachversicherer (VdS), a German fire prevention research institute, lithium-ion batteries can also show explosive reactions due to electrical defects, internal overheating, and external heat dissipation. Indeed, there was an incident last September at Sydney Airport where a lithium-ion battery of an EV ignited, spreading fire to four surrounding cars.

- Destroyer of the Environment

Environmental concerns also arise in producing and disposing of lithium batteries. In terms of production, the main way of extracting lithium is to pump brine from an underground reservoir, pour it into large open-air ponds, and let the water evaporate to acquire concentrated lithium salt. During this process, about 1,900 tons of water is used per ton of lithium, according to 2020 data from the Institute for Energy Research. Hence, this method jeopardizes the environmental balance as it exploits water resources, which reduces vegetation and thereby threatens the environmental balance. Moreover, the disposal of waste lithium batteries causes pollution. As the batteries contain components such as cobalt oxide and nickel, which are designated as toxic substances by the National Institute of Environmental Research, it is unfavorable to treat them by landfill or incineration. Therefore, the waste should be recycled or reused, but the high cost and complexity of the process enable only about 5% of the total amount to be recycled. Processing waste batteries requires the evaluation of their remaining useful life and performance; however, with today’s technology, it takes about eight hours for a single inspection. As large amounts of waste lithium-ion batteries are expected to be generated, it will become an even more overwhelming task to process them with the current facilities and staff in the future.

Lithium-ion Batteries Under Control

- Solutions to Technical Constraints

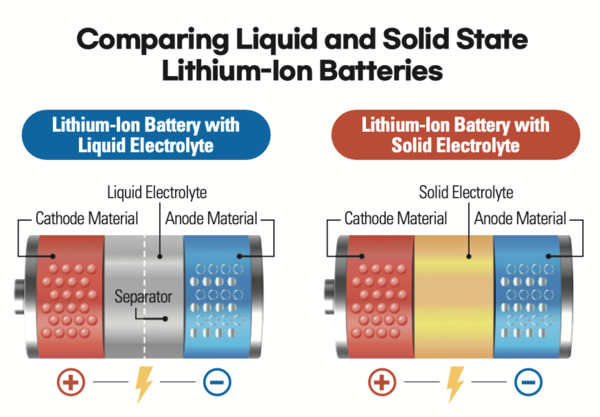

To make up for the technical obstructions, solid-state lithium battery technology must evolve. A solid-state battery uses a solid electrolyte instead of a liquid electrolyte. The solid-state battery does not need a separator since the solid electrolyte also serves as one itself. Moreover, it does not require components for cooling or safety, which allows more space for increasing energy density and battery capacity. Therefore, it is a suitable solution for EVs to reach higher mileage levels. Additionally, solid-state batteries are considered safer for their resistance to temperature changes and external shocks. Nonetheless, considering the essential function of the electrolyte, which enables the smooth transportation of lithium ions, supplementary research is imperative. Furthermore, it is necessary to broaden the functions of the battery management system (BMS). The BMS is a monitoring system that detects and regulates the current, voltage, and temperature of batteries to ensure their optimal use. To achieve higher safety standards, it is crucial to not only improve functions such as abnormality detection warnings but also mandate alarm functions in case of fire and thermal runaway delay functions.

- Measures to Overcome the Environmental Dilemma

Firstly, establishing a sustainable lithium supply chain is inevitable to protect water resources and avert ecosystem destruction. Therefore, ore extraction techniques must be reinforced to diversify lithium extraction methods and reduce costs. POSCO is investigating ways to obtain lithium through non-traditional sources such as clay and dielectric brine. In addition, regulations must be imposed on mining companies. For instance, the European Union (EU) has published its sustainability policy that requires the compliance of impact assessments with the specified upper limit of the battery carbon footprint from 2027. This regulation is expected to make corporations more aware of their impacts on contamination. Lastly, there should be improvements in the waste battery recycling industry since circulating the usage cycle of waste batteries can save energy, leavings, and manufacturing costs. Accordingly, it is necessary to implement a system that reduces inspection time and increases efficiency. Specifically, automating the battery detachment system can be beneficial. An EV user, Kim Tae-yang, told the SKT, “Since many people are indifferent regarding waste batteries, solutions must be scrutinized as soon as possible to alleviate serious environmental harm.” As Korea has no other option now than to rely on imports for lithium supply, resource circulation through the development of recycling technologies is particularly important.

Although lithium is a key component of green energy, it emits large amounts of carbon at the same time. While lithium grants convenience to many, it also threatens the safety of daily life. As global companies’ lithium production is expected to grow again, the SKT hopes for the development of safe and sustainable batteries through innovative technologies to strengthen the competitiveness of Korean-produced batteries in its process.