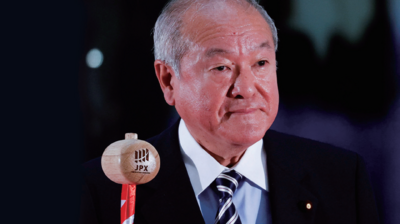

The yen exchange rate against the dollar soared to ¥131.5 on April 28th, the highest in 20 years. Until now, Japan has depreciated the yen value through quantitative easing to activate the economy. Former Prime Minister Shinzo Abe had implemented a stimulating policy called Abenomics, a policy to increase the competitiveness of export companies by depreciating the yen value. However, Shunichi Suzuki, the Minister of Finance of Japan, described the current yen depreciation as a “weak yen.” Fundamentally, quantitative easing should trigger wage increases, further activating the economy and increasing exports, but the stimulating policy yields side effects. Despite the policy, the inflation rate has exceeded the growth of wages, and imports surpassed exports, resulting in a trade deficit. Also, the yen devaluation is accelerating due to rising interest rates in other nations. For example, the United States has induced a strict economic policy that increases interest rates to withdraw its quantitative easing during the pandemic, recording a 5.7% economic growth rate in 2021. However, Japan held a zero-interest rate, recording only 1.7% economic growth. As a result, the yen depreciation is accelerating as investors sell the yen to buy dollars to invest in other countries with higher interest rates. Meanwhile, concerns about the yen value are rising as the Bank of Japan decided to continue its stimulating policy.