According to Bank of Korea report on February 7th, the economic profit of domestic subsidiaries from reinvestment, which refers to retention money from abroad, decreased by around $8.8 billion. This event signifies the occurrence of “capital reshoring,” in which retention money from overseas flowed into Korea for the first time since the currency crisis of 1998. Therefore, the Sungkyun Times (SKT) will explore the multiple aspects of reshoring and how it can step up.

Water That Returns to Shore

-What Is Reshoring?

Reshoring indicates the company’s processing or governmental policy of returning a manufacturer that has been transferred abroad back to its domestic area. The essence of reshoring is the revival of the manufacturing business by bringing back the main production base that was sent abroad with the intention of reducing labor and production costs. Before the Global Economic Crisis in 2008, offshoring, the business process that relocated factories into foreign realms such as China and Mexico as the standard destinations, was mainly led by developed countries. Therefore, the acceleration of the international division of labor and the expansion of the global supply chain, a system that produces and distributes goods across countries, ensued. However, the global financial crisis highlighted the importance of reviving the manufacturing industry that sustains the national economy, bringing reshoring into the spotlight. Serial incidents such as the United States (U.S.)-China Trade War and the Russia-Ukraine War further implicated the danger of locating domestic production facilities in other countries. As the risk of offshoring has gained awareness worldwide, the necessity of reshoring has increased.

-Capital Reshoring in Korea

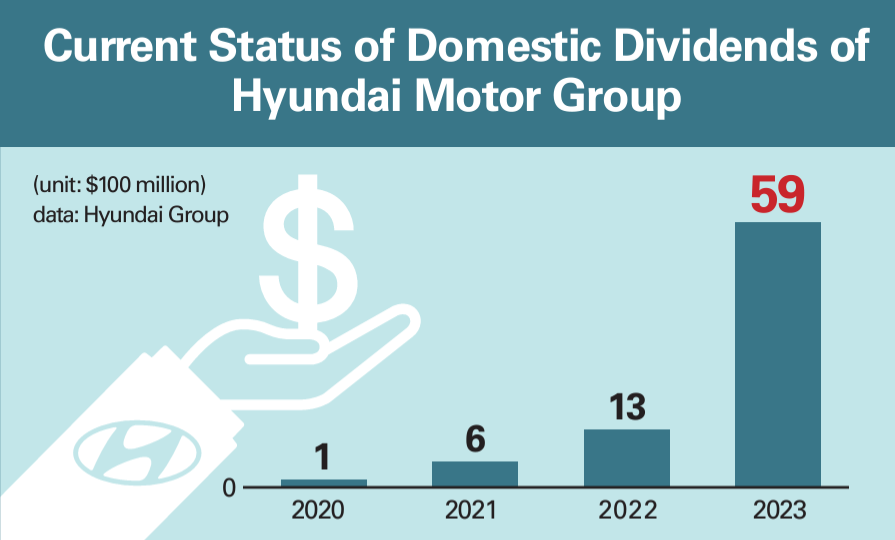

Following the growing interest in reshoring, Korea has also been enacting and enforcing related laws and policies. The reshoring wave started with the legislation of the Act on Assistance to Korean Off-Shore Enterprises in Repatriation, also called the U-Turn Act, in 2013. In 2020, the U-Turn Act was revised to modify the conditions of companies eligible for governmental support. As a result, the scope of companies qualified for aid under the legislation was expanded to include not only manufacturing but also information and communications technology (ICT) and knowledge-intensive services. The revision also facilitated the return of companies to the domestic field by easing occupancy requirements. As a result, capital reshoring occurred in February 2024 as the retention money from overseas entered Korea. The main reason for capital reshoring was the revision of the Corporate Tax Act. Before reorganization, the act imposed double taxation on companies until 2022; however, the revision in 2023 excluded 95% of dividends brought into Korea, implying only 5% of dividends would become taxable. Subsequently, conglomerates such as Hyundai Motor Company and Samsung Electronics imported the retention money from overseas to expand domestic investment.

Exploring the Strategy of Reshoring

-A Geographical Strategy

1. Inside the Factory

The most symbolic advantage of reshoring is that it alleviates the issues stemming from offshoring, such as technology leaks and difficulties of factory tracking. In an interview with the SKT, an economics instructor stated, “In manufacturing, taking competitive advantage of technology is a crucial aspect.” When a production line using core technology is located in the nation, the concerns of technology leaks and duplication naturally diminish. At an open debate to promote the reshoring of the domestic high-tech industries held in September 2023, Kim Seongwon, a member of the People Power Party, noted that global companies such as Apple, Boeing, and General Electric are practicing reshoring to stabilize the management environment while reducing the geopolitical risks and preventing technology leaks. If reshoring minimizes the potential of a technology leak, the positive influence within the industries will also be enlarged as a chain reaction. Furthermore, reshoring allows companies to track the entire manufacturing process and sections that cause errors by examining the production line. Thus, when problems arise within the company, rapid improvement can be made immediately, increasing the efficiency of factory operations. With the popularization of the idea that the global supply chain is not safe enough, reshoring has started to gain power with a company’s belief that reshoring helps focus on the domestic field by ensuring safe factory operations.

2. Outside the Factory

The advantages of reshoring are not just to be found inside the factory but also outside the factory. As the distance between the consumer market and manufacturing facilities draws closer, transportation distance and logistical costs are minimized spontaneously. In addition, reshoring also reduces the time and costs of shipment, ultimately improving consumer satisfaction. Adidas, for example, moved its factory in 2017 from Southeast Asia to its country of origin, Germany, based on an analysis that its primary consumers were in Europe. In short, corporate and brand value advancement will be boosted together as reshoring leads to better consumer awareness. Furthermore, reshoring holds the potential to induce more employment and investment expansion in the long term. According to the Reshoring Initiative, after the coronavirus disease 2019 (COVID-19) outbreak, the workforce brought to American corporations measured in 2022 was enormous. Recently, there has been a positive outlook for employment and investment expansion in Korea owing to capital reshoring. Lim Dong-won of the Korea Economic Research Institute commented in an interview with the Seoul Economic Daily that the employment sector will be revitalized as global companies begin to increase their domestic investments by conducting reshoring.

-Loopholes in the Strategy

1. No Impact

Although reshoring seems to be an ideal policy due to its various practical benefits, its effectiveness in Korea remains questionable, considering recent statistics and research. According to the study of the Korea Development Institute (KDI) in November 2023, the domestic companies that conducted reshoring mainly operated businesses on a small scale and were relatively labor-intensive. In addition, KDI revealed that reshoring does not have a significant impact on fostering employment. The employment of the reshoring companies increased by 2.3% annually, and net employment compared to net investment was only 1.17 employees per ₩1 billion, lower than that of scalable enterprises with 1.32 and pure domestic firms with 2.48. Furthermore, KDI analyzed that these companies have a low probability of overseas investment due to less data and experience in production. In fact, only 17% of multinational corporations that conducted reshoring in the 2010s have expanded their investments since then, while 29.6% have chosen to withhold or reduce their investments. Therefore, reshoring has been assessed as hardly beneficial to the domestic economy. Providing discriminative benefits to reshoring companies with explicitly lower employment and investment will disturb the stability of the national supply chain.

2. Trade-Off

Problems linked to labor rights also bring questions about the effectiveness of reshoring. According to a survey conducted by the Korea Enterprises Federation in 2022, 93% of 306 companies that expanded internationally stated they had no plans for reshoring. The most significant proportion of the reason that hinders reshoring was high labor costs, which account for 29.4%, and strict regulations of wages and dismissal were also substantial reasons. From 2010 to 2018, labor costs in 10 major Organization for Economic Co-Operation and Development (OECD) countries rated an annual fall of 0.8%, while Korea rose by 25%. Since the companies left Korea due to high labor costs, easing labor regulations to induce reshoring would be the most significant request of those companies. However, reducing such labor regulations would be only favoring the demand of companies, leading to the neglect of employees’ current situations and worsening labor rights. Thus, conducting reshoring causes a paradoxical situation in which reshoring promoted by the government with the goal of contributing to the expansion of employment could adversely lead to a violation of labor rights.

Robust Design of Reshoring

-More Strategic Strategy

Fundamentally, the government needs to set a specified goal by developing its existing one-size-fits-all policies, such as tax cuts and reduction of factory relocation costs. Based on these specific objectives, differentiating incentives for each industry would increase the efficacy of reshoring. Specifically, promoting reshoring by targeting companies that can effectively increase employment and activate domestic investment can contribute to the national economy. Corporations, on the other hand, must strategize reshoring, considering not only governmental incentives but also other factors. For example, SK and LG are speeding up their overseas investment, mainly in the battery business, despite the decline in corporate tax. After deciding on reshoring, companies must analyze the concrete strategies of preceding companies that initiated the plan. Professor Ryu Joo-han of the Department of International Studies at Hanyang University asserted, “A clear understanding of earlier companies’ industrial property, brand characteristics, and effective attraction policies is crucial.” Essentially, companies should avoid the dichotomous way of choosing between reshoring and offshoring. Attempting overseas expansion and returning to the country should therefore be continually weighed up.

-Smart Factory and Smart Discourse

Primarily, considering the discordance between the companies’ demands for easing labor standards and the workers’ labor rights is crucial in the initiation of reshoring. To maximize the protection of workers’ rights, sufficient discussion among the government, companies, and labor unions is imperative. Forums that are regularly held and specially monitored to listen to the voices of workers who play critical roles in the industry can prevent the implementation of reshoring from violating labor rights. From a company standpoint, they can operate their plants in the form of smart factories to address difficulties regarding labor regulations and costs. A smart factory refers to an entirely automated production system based on the application of ICT. The system consists of heightened efficiency and lowered labor costs using three-dimensional (3D) printing and robot technology. The advent of smart factories may cause concerns about the automation of existing work; however, new tasks such as data analysis and system maintenance would emerge with new technologies and production methods. For workers to meet the skill levels required in these new roles, policy support from the government, which provides companies with educational incentives for raising the workers’ competence, would help.

Based on a variety of advantages, reshoring is a convincing policy. However, behind the scenes, the lack of its economic effects and the threat to laborers’ rights exist. The SKT recommends that Kingos think about the way to catch both rabbits, the solution to the dilemma arising from the development of technology, and the ways to improve the influence of reshoring.