Last January, the monetary value of online shopping mall transactions exceeded over ₩227 trillion, according to Statistics Korea. Since many Koreans now choose to shop online, the e-commerce market has grown to a significant scale. However, its recent growth has faced many problems. Thus, the Sungkyun Times (SKT) will examine the current issues and the expected future of the e-commerce market in Korea.

E-Commerce: The New Era Begins

-Unveiling the History of Online Shopping

E-commerce, known as online shopping, refers to the buying and selling of goods and services through the internet. With the emergence of personal computer communication, big Korean e-commerce brands, such as Interpark and Lotte E-Commerce, first surfaced in June 1996. Since then, people have started actively establishing online stores and companies such as Cafe 24 and MakeShop, which helped the foundation of other individual stores. In the 2010s, the mobile market enabled the vast expansion of e-commerce, forming the cornerstone of the current well-known online shopping platforms such as Tmon, Coupang, and Wemakeprice. Moreover, the globalization of e-commerce has allowed consumers to enjoy cross-border shopping, which means people can buy overseas products directly online. Subsequently, overseas online shopping businesses, such as AliExpress and Temu, were introduced into the Korean market. They are growing at speed, with their high competence achieved through price discrimination and active advertisement. In this way, e-commerce has settled itself as an essential service in many people’s lives.

-Transcending Offline Shopping

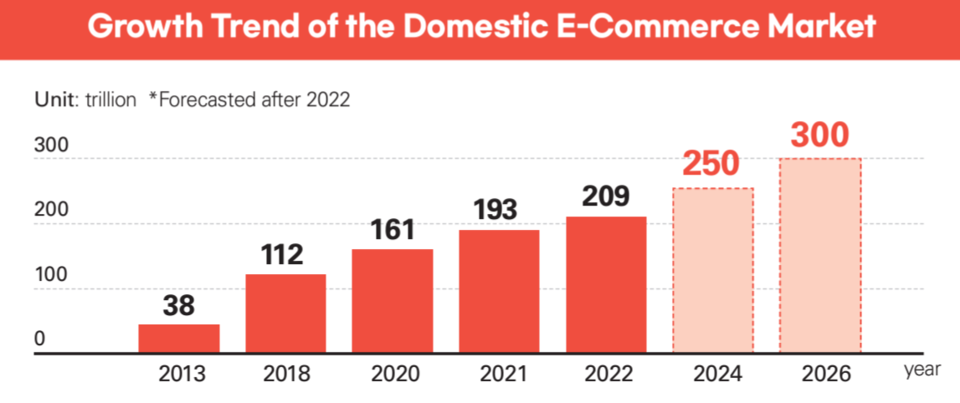

Currently, the size of the e-commerce market has continued to grow, surpassing offline shopping. According to 2024 data from the Ministry of Trade, Industry, and Energy (MOTIE), e-commerce stores have taken up 50.5% of total distribution sales, surpassing offline stores for the first time in 2023. The most significant factor was the internet breaking the limits of space and time. Using internet shopping eliminates the need to travel to make purchases; therefore, it lessens the burden on consumers, particularly in terms of time, transportation costs, and energy. Also, online shopping has an advantage in terms of customer satisfaction and convenience. Major e-commerce platforms such as Naver allow consumers to easily see complex processes in one view. Furthermore, with the advent of artificial intelligence (AI), e-commerce companies recommend customized goods based on customers’ preferences and detailed requirements. Currently, with the consumers’ increasing interest in cross-border shopping, they also make use of overseas e-commerce services that make purchases much more convenient. These consumer-friendly functions surpassing the limits of offline purchases have supported the successful growth of e-commerce.

Domestic E-Commerce Now in Trouble

-Wallowing in the Swamp of Muted Growth

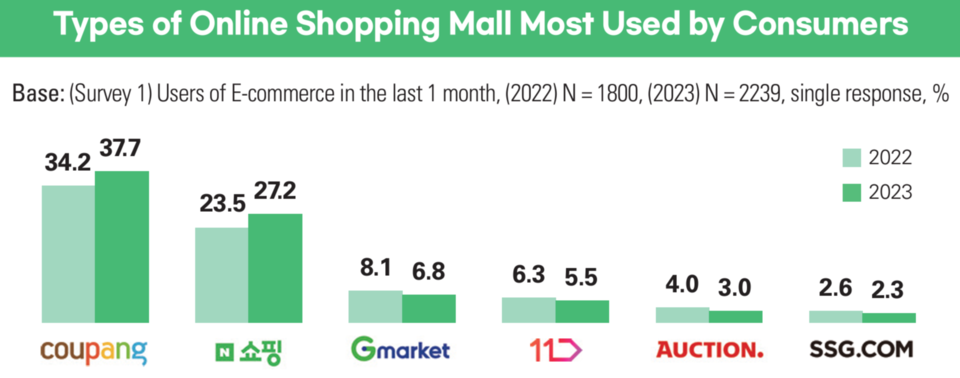

The e-commerce market is now recording high sales; however, its growth rate is not as high. In fact, according to a report by The Korea Economic Daily released last December, the e-commerce market has faced a downturn, with the growth rate declining from 18.4% in 2020 to 9.5% in 2023. The increasing demand for offline malls with the end of the pandemic and the freezing of consumer confidence due to inflation and recession significantly decreased online purchase rates. Moreover, major e-commerce enterprises such as Coupang and Naver Shopping have formed an oligopoly, which creates other significant obstacles. In 2024, according to the Opensurvey, the market share of Coupang and Naver Shopping is 24.5% and 23.3%, respectively, with the two companies accounting for half of the market. This market structure can lead to problems such as price increases, which raise the burden on consumers. This year, Coupang grappled with controversy because they increased the price of the Wow membership, including free delivery service, from ₩4,990 up to ₩7,890 by using their domineering position in the market. Although the company added more benefits to the membership, consumers still complained about price increases, which were not in line with the quality of the service. However, despite this escalation of customer dissatisfaction, in an interview with SKT, an e-commerce consumer said, “As Coupang provides irreplaceable service with various products and services, I always end up using Coupang.” Due to this dispersion and decrease in e-commerce market demand, the market is now facing a severe crisis.

-Overseas E-Commerce Crashing Domestic Market

Apart from the disputes in domestic e-commerce, cross-border e-commerce, which has earned significant consumption from Korean consumers, indirectly causes the market share of domestic e-commerce companies to shrink. Since cross-border e-commerce is exempt from transit tax, it benefits from significant advantages in price competition. Moreover, cross-border e-commerce cannot prove its safety because of the exemption in Korea Certification (KC). In September 2021, according to the Maeil Business Newspaper, children’s toys on the Amazon Global Store are now being sold without the KC marking. Due to this lax regulation, Korean customers may be affected by unregulated products. For instance, in the April analysis of Incheon Main Customs (IMC), one out of four products from Chinese e-commerce contained harmful substances, such as cadmium and lead, at least 10 to 700 times higher than the Korean safety standards. Also, Temu, one of the most influential Chinese e-commerce businesses, has a dispute on providing customers’ personal information to the Chinese Government, which has become more controversial.

Rehabilitating the Korean E-Commerce

-Fixing the Domestic Flaws First

To overcome the ongoing low growth of the Korean domestic e-commerce market, the company should maximize its strength for being online by improving active business services and enhancing the diversity and convenience of buyers’ choices. For example, using AI can analyze consumers’ preferences in reflecting their feedback and upgrading their functions. Platform Law, which the Fair Trade Commission (FTC) is planning to legislate, can be the solution for the domestic oligopoly. Through this Law, the large platform companies that are designated as monopolistic platforms will receive strict regulations in their preferential treatment and be fined up to 10% of their sales in case of violation. With the regulation, equivalent competition with small platforms in the domestic e-commerce market will be possible. Moreover, activating the lock-in effect by differentiating from other companies, which makes the consumers rely on the suppliers, can strengthen the competitiveness of e-commerce. Using these methods can encourage stabilization and vitalization in the e-commerce market.

- For Trustworthy Cross-Border E-Commerce

The lenient regulations on overseas e-commerce affecting Korean companies and consumers should be addressed. First, supporting Korean domestic companies facing disadvantages in price competition due to the absence of transit tax and KC marking requirements for overseas e-commerce is imperative. For this, the government can reduce the cost of the inspection for the certificated KC marks. By decreasing the financial burden on Korean e-commerce companies, this governmental support would cause them to lower their product prices, which were initially high due to the expensive KC marks. This solution would put Korean companies in a relatively equal position as overseas e-commerce platforms in price competition. Furthermore, discussing the controversy regarding toxic substances in overseas e-commerce is also important. In April 2024, the FTC reported that it would identify the scale of damage by implementing a factual survey of the entire e-commerce market and make a protection policy based on the result. One Temu consumer told the SKT, “I tried to refund the item I bought from Temu, but there have been no replies for two weeks. I wish consumers could be protected from these purchase experiences.” The FTC also amended the Act on Consumer Protection in Electronic Commerce to make the designation of domestic agents mandatory. This revision would pair overseas companies with a Korean agency, which would be in charge of handling consumer complaints and disputes.

Korea’s e-commerce market has grown rapidly. However, the market is now in chaos, constantly bringing up consumer complaints. Thus, it is necessary not only to pursue growth but also to continuously identify and improve problems for market development. The SKT hopes that the current crisis in Korea’s e-commerce market can be remembered as a growing pain for a better future.