Last January, according to Clarksons Research, a maritime and shipbuilding research institution, South Korea ranked second in global ship orders. While Korea’s shipbuilding industry has been a key player the international market with advanced technology, difficulties such as labor shortages and fluctuations in raw materials costs have surfaced. The Sungkyun Times (SKT) aims to explore the concerns facing Korea’s shipbuilding industry and potential solutions within the its current trends.

Navigating Korea's Maritime Engineering

Maritime engineering, commonly known as shipbuilding, is an industry that designs and constructs ships. In Korea, it began to develop in the 1950s during the Korean War when it took charge of repairing United States (U.S.) military vessels. In the 1970s, the government prioritized developing the chemical industry, leading to extensive growth in shipbuilding companies, including HD Hyundai Heavy Industries (HHI) and Samsung Heavy Industries (SHI). Since then, the country has emerged as one of the most powerful nations in shipbuilding, specializing in high-value added ships for transporting fuels, such as Very Large Crude (VLC) and Liquefied Natural Gas (LNG) carriers.

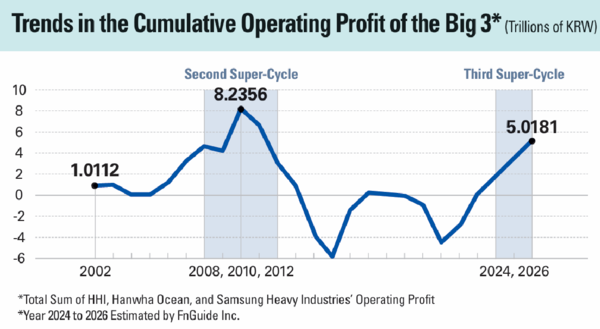

The most significant trait of Korea’s maritime engineering is the so called super-cycle, a recurring pattern of long-term prosperity followed by downturns. According to the Korea Development Institute (KDI), ship construction usually takes about three years, and the cycle returns every 20 to 30 years when aging ships are replaced. This makes strategic planning necessary to maintain competitiveness. According to the Ministry of Trade, Industry and Energy (MOTIE), because the super-cycle returned earlier than expected in 2023, the sales of the three major shipbuilders in terms of operating profit are expected to increase by 7% to 10% this year. One of the key reasons behind the early onset of this super-cycle is the increased demand for eco-friendly ships spurred by climate change regulations.

In 2023, the International Maritime Organization announced the goal of achieving net-zero carbon emissions from ships by 2050, tightening environmental regulations. In addition, the European Union is now switching the global shipping business to using green ships by enforcing emissions penalties. Korea has been showing an advantage as the demand for green ships increases, especially in LNG-fueled ships, where it accounts for half of global LNG-fueled ship orders. Given these advancements, the expectations for green ship orders continue to rise.

Obstacles Rising in Shipbuilding

-The Conundrum of Uncertainty

Despite the promising market trends, the shipbuilding industry faces several challenges. First, the rising costs of raw materials and components put financial pressure on the industry. The newly enacted Anti-Dumping Duty has raised the price of thick metal plates, and small and medium-sized businesses (SMBs) that rely on imports from China are likely to face negative impacts. Also, the U.S. imposed a 25% tariff on key raw materials such as steel and aluminum in April, a policy that, even prior to its enactment, had led to an increase in copper prices by up to 11%. These issues and uncertainties threaten the industry’s profitability and intensify competition for securing new ship orders.

Meanwhile, China’s rapid expansion in shipbuilding poses a significant threat to Korea’s global market standing. According to the Export-Import Bank of Korea, China now holds a share of 70% of global ship orders, a 10% increase from last year, while Korea’s share has declined from 20.6% to 18.1%. Although Korea is second in the industry, experts warn that the widening gap with China threatens its position. One key reason for this deepening disparity is the Chinese government’s aggressive investment in large-scale dockyards. Furthermore, according to Clarksons Research, China is even making significant progress in green shipbuilding, including Ammonia-Methanol-fueled and LNG-fueled ships, which were once Korea’s stronghold. With China’s rapid advancements, experts caution that Korea may not be able to maintain its technological superiority in the industry.

-Dwindling Young Labor

Beyond technological and global market issues, the most prominent problem in the shipbuilding industry is the severe shortage of human resources. According to the Korea Employment Information Service (KEIS), Geoje Island, a hub for significant shipyards, has seen its youth population decline from more than 77,000 in 2014 to around 46,000 in 2023, showing the fastest decline rate in the country. Despite the recent recovery of the industry, young workers are not returning, which means the workforce pool has decreased significantly. This young labor shortage can particularly be attributed to concerns about workplace safety. According to the Ministry of Employment and Labor (MOEL), casualties in ship construction showed a general upward trend until 2023, when it reached 1,652 industrial accident victims. In an interview with the SKT, an engineer from SHI stated, “Although safety measures and working conditions have improved, accident risks still exist, which has made some employees change jobs.” Despite these concerns, improvements in the working environment and safety education remain insufficient. Last March, Dong-a Ilbo highlighted that tighter construction schedules have increased subcontracting, which creates a chaotic work environment where workers must endure riskier operations. Consequently, with young workers opting for safer and higher-paying jobs, this trend will likely persist if the current problems within the shipbuilding industry are not addressed.

A Compass in the Storm

-Strategies for Navigating Upcoming Risks

The shipbuilding industry must adopt proactive strategies to grasp future opportunities and sustain growth. First, companies must mitigate large raw material price fluctuations through stockpiling and diversifying supply chains. For example, when automotive semiconductor shortages threatened production last November, the automobile manufacturer Kia Motors minimized long-term supply risks by stocking inventory. Similarly, shipbuilders should avoid relying on specific countries or businesses and instead cooperate with diverse suppliers to distribute risks. As for the competition with China’s shipbuilding industry, Korea can strengthen its global standing by collaborating with the U.S., which has been actively countering China’s rise in the industry. Since last year, the U.S. has been losing competitiveness due to low productivity and high labor costs, entrusting Korean shipbuilding companies that have been participating in the Maintenance, Repair, and Operations (MRO) of U.S. naval ships. Notably, during his speech at the National Assembly last March, U.S. President Trump expressed interest in cooperating with Korea’s shipbuilding companies, opening a new chance for Korea. With these measures, the industry will overcome its operation risks and reinforce its strength in the global market.

-Expanding the Sustainable Workforce

Addressing the labor shortage problem requires improving workplace safety to attract young workers. Expanding equipment maintenance and reinforcing safety measures are essential for reducing industrial accidents. In Korea, the Serious Accidents Punishment Act, enacted in 2022, was extended to small businesses last January. Accordingly, large shipbuilding companies should collaborate with their subcontractors to prevent accidents occurring in legal blind spots. A supplemented supervisory and regular inspection systems will improve companies’ safety management capabilities and working conditions for its employees. Meanwhile, enhanced training programs are also crucial. Many local governments are now enforcing industrial safety education programs for construction workers by teaching legal measures with case examples of accidents. Given the high risk of accidents in the shipbuilding industry, similar field-focused training programs should be widely adopted, especially for SMBs. An SHI engineer interviewed by the SKT emphasized, “Beyond theoretical education, practical hands-on training like f ire drills would be highly beneficial for the workers.” Creating a safe work environment will protect employees and improve corporate reputation, ultimately strengthening the industry’s workforce in the long run.

Korea’s shipbuilding industry is now setting sail once again. With this, it must focus on improving production rates and creating a stable growth structure so as not to lose its way on the journey. To maintain an upward trend in the constantly changing market, efforts to improve the industrial structure should be supported. With a solid foundation and thorough preparation, Korea’s shipbuilding industry will be able to sail conf idently into the future.